April, 2024

UP Chapter Fun!

Another April means another UP annual meeting in the beautiful north! As with previous years, I was fortunate enough to attend our UP Chapter’s annual meeting and convention. What a great group of credit union champions! I was happy to attend alongside some of our MCUL team — Andrea, DaeSean, Tony, Brad and Mary Comar from CUSG. We all had a blast!

Another April means another UP annual meeting in the beautiful north! As with previous years, I was fortunate enough to attend our UP Chapter’s annual meeting and convention. What a great group of credit union champions! I was happy to attend alongside some of our MCUL team — Andrea, DaeSean, Tony, Brad and Mary Comar from CUSG. We all had a blast!

I enjoyed meeting up on Thursday night and connecting with some folks that I do not get a chance to see very often. On Friday, I gave my MCUL update to the chapter and had a fun time with the YPs participating in a roller coaster building contest. Unfortunately, my team did not win but I still think our coaster was the best! The evening brought the annual party with credit union supporters all around. I hung out at our foundation booth and the CUSG booth.

I enjoyed meeting up on Thursday night and connecting with some folks that I do not get a chance to see very often. On Friday, I gave my MCUL update to the chapter and had a fun time with the YPs participating in a roller coaster building contest. Unfortunately, my team did not win but I still think our coaster was the best! The evening brought the annual party with credit union supporters all around. I hung out at our foundation booth and the CUSG booth.

You can bet that I was thrilled to learn that my dear friend, Connie Toensing, was being honored at the meeting with a Distinguished Service Award!!! Not only is Connie on our MCUL board, she also was the long-time President/CEO of Chippewa County Credit Union that recently was part of a three-credit-union merger in the UP. Connie clearly knows her community and is well-respected by her peers. As for me, Connie has been a true supporter of mine since I joined MCUL and often offers me feedback, guidance and kudos. I appreciate her so much and love hanging with her and being a “real person” [private joke; Connie will get it]!

You can bet that I was thrilled to learn that my dear friend, Connie Toensing, was being honored at the meeting with a Distinguished Service Award!!! Not only is Connie on our MCUL board, she also was the long-time President/CEO of Chippewa County Credit Union that recently was part of a three-credit-union merger in the UP. Connie clearly knows her community and is well-respected by her peers. As for me, Connie has been a true supporter of mine since I joined MCUL and often offers me feedback, guidance and kudos. I appreciate her so much and love hanging with her and being a “real person” [private joke; Connie will get it]!

Saturday morning had me attending the UP Annual Meeting, where our own Tony Zorza did a great job. It was really a joy to hear all the amazing work that our friends in the north are up to. What a passionate group of credit union professionals. I then found myself, along with MCUF Board Member Jennifer Watson, hanging out with some pretty dynamic young professionals that are part of the FUEL group in the UP. A very impressive group that I was happy to share my story with and hopefully left them with a few bits of wisdom?!!

I also want to take this time to talk about the Pat Ruecker AC+E Scholarship. Did you know that in 2019, MCUL created a scholarship as a way to honor Pat, former president of Marquette Catholic Credit Union (now Embers Credit Union), who was one of the pioneers of the credit union movement in the U.P?

In the spirit of Pat’s legacy, the scholarship is an annual award given to ambitious, driven, goal-oriented professionals from the U.P. Chapter who have a background of consiste nt community involvement or credit union service. This year, that honor goes to Melissa Bricco of Soo Co-op Credit Union. Congratulations, Melissa! I was also pleased to announce that this scholarship will continue on for another 10 years! See you in Traverse City, Melissa!

nt community involvement or credit union service. This year, that honor goes to Melissa Bricco of Soo Co-op Credit Union. Congratulations, Melissa! I was also pleased to announce that this scholarship will continue on for another 10 years! See you in Traverse City, Melissa!

Thanks for reading in on my UP adventure. To conclude my trip, I was so amazed to see the beautiful shoreline of Lake Michigan on my way south to the Mackinac Bridge. The beauty of the UP is truly inspiring! Catch you soon!

Keeping Board Members Connected

For many of you reading this, I know that you live and breathe the credit union industry. This is your passion and you bring that to work everyday. But I also know that many of our credit unions’ board members may not be reading this nor do they see some of our MCUL publications! While our boards are passionate about their individual credit unions, they may not necessarily be looped into our top-of-mind legislative priorities or the other challenges we face, generally, as an industry.

For many of you reading this, I know that you live and breathe the credit union industry. This is your passion and you bring that to work everyday. But I also know that many of our credit unions’ board members may not be reading this nor do they see some of our MCUL publications! While our boards are passionate about their individual credit unions, they may not necessarily be looped into our top-of-mind legislative priorities or the other challenges we face, generally, as an industry.

That’s why MCUL has put together some events throughout the year to help volunteers stay up to date on the relevant trends and topics that credit unions are currently navigating. In just a couple weeks, we are hosting the Spring Leadership Development Conference in Mt. Pleasant. If you’ve never been before, it’s a three-day event designed to put board members in a place where they feel prepared and confident to lead their credit union.

Specific to this year’s event are sessions on innovative leadership and an economic forecast that will educate volunteers on credit unions’ current operating environment. We’ve also put together more targeted sessions on Bank Secrecy Act/Anti-Money Laundering training for board members, executive recruitment and succession planning and what volunteers should know about compliance, as well as plenty others.

The Spring Leadership Development Conference isn’t the only event we offer sessions for volunteers — our Annual Conference & Exposition and Fall Leadership Development Conference are also great for board members — but I do think that it’s a unique conference for new volunteers to better understand their role and for seasoned volunteers to learn about our changing financial services landscape.

But attending the conference, like any MCUL education event, is never about an attendee coming to sit down, receive information and then leave. These events are also an opportunity for attendees to expand their network, engage with partners and support the credit union movement. These are also opportunities for our board volunteers to understand and appreciate the challenges our industry faces and get them outside of their individual credit union bubbles.

Like any strong movement, we’re built on collaboration, and events like the Spring Leadership Development Conference, AC&E and Fall Leadership Development Conference — places where we gather — I believe are perfect spaces for us to lean into that collaboration and grow as an industry.

March, 2024

Making Financial Education Easier: MCUF Offers Free Toolkit for Credit Union Youth Month

Happy first day of Spring! With Spring finally here, that means April is right around the corner. And for credit unions, April means a couple things: National Financial Literacy Month and Credit Union Youth Month.

Happy first day of Spring! With Spring finally here, that means April is right around the corner. And for credit unions, April means a couple things: National Financial Literacy Month and Credit Union Youth Month.

To celebrate this year, the Michigan Credit Union Foundation (MCUF) has partnered with My First Nest Egg to offer Michigan credit unions free materials to use this April. We’ve put together a toolkit designed for credit unions to empower parents with the resources to make money-based conversations with kids easy and impactful.

The toolkit includes a detailed parent guide, an interactive map for kids and some engaging social media posts. The interactive map is especially fun, since it’s filled with videos and fun games that should make learning about money exciting for kids.

We want the toolkit to make it as convenient as possible for credit unions to participate in Credit Union Youth Month. All you’ll have to do is follow the printing guidelines for in-house activities, or add it to your website for a virtual experience for youth members.

Materials for the full Youth Month toolkit are available online on our website, and are free for Michigan credit unions, thanks to funding provided by MCUF.

We all know how important it is to have conversations with young people about the healthy financial paths that lie ahead for them, and we appreciate the time and effort that Michigan credit unions dedicate to these conversations. Hopefully, our toolkit makes this year’s Credit Union Youth Month a little bit easier.

- Share on Facebook: Making Financial Education Easier: MCUF Offers Free Toolkit for Credit Union Youth Month

- Share on Twitter: Making Financial Education Easier: MCUF Offers Free Toolkit for Credit Union Youth Month

- Share on LinkedIn: Making Financial Education Easier: MCUF Offers Free Toolkit for Credit Union Youth Month

- Share on Pinterest: Making Financial Education Easier: MCUF Offers Free Toolkit for Credit Union Youth Month

A Woman’s Mid-Life Perspective

I am grateful that Renée Sattiewhite reached out asking me to write an article for Women’s Month this year. When Renée calls, I answer. I am sure I am not alone! My caveat is that I am not a writer; but, as a component of my role in our credit union industry, I am regularly trying to brainstorm topics for communications. My “go-to” topics have our credit union movement as the subject, and there are certainly several options. I could write about our continued advocacy on some tough issues and barriers that exist today. I could also write about, for example, how we are under attack for charging for products such as courtesy pay. Another great topic would be on regulatory scrutiny or how credit unions are incorporating and partnering with fintech. All of these are relevant topics worthy of an article. But if I am being honest, I enjoy writing about more personal topics the most. And based on feedback I receive on my blog or in past articles, I find that those are the articles that resonate with people. So, that is where I landed.

I am grateful that Renée Sattiewhite reached out asking me to write an article for Women’s Month this year. When Renée calls, I answer. I am sure I am not alone! My caveat is that I am not a writer; but, as a component of my role in our credit union industry, I am regularly trying to brainstorm topics for communications. My “go-to” topics have our credit union movement as the subject, and there are certainly several options. I could write about our continued advocacy on some tough issues and barriers that exist today. I could also write about, for example, how we are under attack for charging for products such as courtesy pay. Another great topic would be on regulatory scrutiny or how credit unions are incorporating and partnering with fintech. All of these are relevant topics worthy of an article. But if I am being honest, I enjoy writing about more personal topics the most. And based on feedback I receive on my blog or in past articles, I find that those are the articles that resonate with people. So, that is where I landed.

Turning 52 years young this month, I find myself reflecting on past and future. There are two women in my life that are dear to me and that have me reflecting on where I have been and, if I am lucky, where I am going. Motivation to look back in time comes from my daughter, Julia, as she travels down a road I have also ventured. On the other side, is Lolly, Julia’s grandmother. I am thirty years older than my daughter, now 22, and thirty years younger than Lolly, who turns 82 this month.

Looking back, as my daughter enters the work-force post college, it reminds me of all those years of uncertainty and insecurity mixed in with excitement and energy that I went through. Starting out was hard! As a young lawyer – sometimes called a “lady lawyer” (insert eyeroll), I was often litigating against men much older and more experienced and often in front of a male judge. I would often look around the courtroom when I started practicing law and feel a bit isolated as there weren’t too many people that looked like me. Women have really made progress in this space which is nice to see. Also, I don’t recall interacting with any women attorneys of color in my early years. And while still not perfect, I now see more women of color in the legal industry. The first ten or so years of our career is so exciting, uncertain and scary.

Today, I have a front row seat to my daughter’s first steps into the corporate world and office politics. Things have definitely changed for the better in terms of representation. Also, leaders of organizations are adapting to this generation that values family and downtime. This generation does not consider reasonable working hours a “perk” but a requirement. My daughter was asked during her onboarding to share things such as – how do you prefer to communicate, what is something that is essential for you to do each day and are you a morning or evening person, etc. Some companies really try to know their employees to make their experience richer. I see credit unions also investing more time and resources into their young professionals. Today’s recruits are more vocal on their needs, and it has forced us to get over such notions as “this is how it has always been” and “I had to work these hours, so should you.” Most people are now encouraged to use their PTO/vacation days and share on social media about their adventures. Back in my day, it was a badge of honor to not use all your days and you kept any vacation experience sharing to a minimum. I am so pleased that this has changed.

In a recent podcast that I was listening to – it was suggested to look back at your younger self and present your past-self with the professional role you have now and ask yourself if you would have been surprised and impressed. This is supposed to be a helpful way to evaluate and credit ourselves with our success. Ask yourself: Did your younger self ever envision the professional life you have today? I can honestly answer that question in the negative. When I think back to myself in my twenties and thirties, I would have never guessed that I would be leading the Michigan Credit Union League and about to also step into the CEO role of CU Solutions Group. It would have blown my mind back then and sometimes, it still does!

When I look ahead to my next thirty years, I think of Lolly, who turns 82 this year. She has a home in Michigan and Florida and revels in time with her friends and family. She regularly wears heels, dines out often and enjoys a vodka martini! She always says yes to an adventure. She attends concerts, plays cards, drives a cool car, texts and posts on Facebook and even enjoys a ride on the back of a Vespa in Rome! She lives her life – every day – and she is grateful for it. She has also survived the loss of her best friend and husband, Howard, and cared for him as she watched Parkinson’s disease take him from her. On top of all of this, she is a four-time cancer survivor. She never quits; and even during her challenges, always takes your phone call, quickly responds to your text, sends you a birthday card, is devoted to her many friends and family and never complains. Even as I type this, she does not sound real, but she is. If I am half of who Lolly is at her age, should I be fortunate enough to make it, I will consider myself very lucky.

Where we have been, where we are, and where we are going are most likely all very different snapshots for all of us. I am glad to have learned to be grateful for my past and present and to enjoy and embrace where I am. As for the future, I really do not focus on it too much as I have learned all too well how things change on a dime, and nothing is guaranteed. I challenge you, during this Women’s Month, to reflect on the challenges you have conquered and to celebrate where you are. Do not overlook all that you have overcome to get where you are, personally and professionally. Celebrate you and think about the Julia’s and Lolly’s in your life. I hope you have some great examples that bring you a smile and offer some sweet reflection and hope for the future.

By Patty Corkery

Originally published on CUInsight.com

February, 2024

We Are 90!

Big news – we are turning ninety this year! The Michigan Credit Union League (MCUL) has been serving Michigan credit unions for nine decades. We are so proud to have been launched in 1934. As most of you reading this blog know, our Credit Union National Association was organized in Estes Park, Colorado in August of 1934. In order to approve the constitution and bylaws of the new national association, Michigan credit unions had to organize a League. According to The History of the Michigan Credit Union League, on October 4, 1934, with seventeen credit unions participating with 34 delegates and some alternates, the League was officially formed.

My hat is off to the founder and first president of the MCUL, Sam Smith! Mr. Smith was the president of Detroit Federal Employees Credit Union (now People Driven). In 1934, there were 66 credit unions in Michigan and, as we know, the numbers continued to grow. Just twenty years later, in 1954, there were 782 credit unions in Michigan. Wow! The MCUL was incredibly busy during that time and thereafter!

Looking at our history is really fascinating, and I could spend several blogs highlighting information in the 872 page MCUL history book (by the way, there is also a Volume II!), but needless to say, we have been around for ninety years and we are still going strong.

Does this history lesson inspire you to want to come celebrate with us? If you're reading this, registration to our Annual Convention & Exposition is open. Don’t believe me? Click here to see for yourself: Register for the AC&E

Please be sure to register for the conference to get a confirmation number for your hotel booking (guidance from our amazing education team).

We are heading out to Traverse City for the AC+E and would love to have you join us. You are going to experience all that you are accustomed to along with some incredible new content and top-notch education. And of course, there will be parties! We hope you join us for Dave Adams’ Victory Lap as we celebrate Dave’s last annual convention as a member of our team while he gears up for retirement. There will be amazing prizes to bid on at our Children’s Miracle Network auction as well as wine and craft beer at our foundation fundraiser. I am also very excited to celebrate the people and credit unions who are receiving awards at our MCUL Awards Gala! Winners will be announced soon!

Did I mention there will be golf and a fun run as well? We will also be highlighting some of our amazing credit union partners that serve as sponsors and supporters of the event in our expo room. So much to do. But, as we all agree, the best part of this event is connecting with your credit union friends and meeting new ones. The networking and connecting is what makes this the best credit union event of the year. I will be there; will you join me?

[Facts about MCUL and our credit unions stated in this blog were found in The History of the Michigan Credit Union League; Crews, Cecil R., Detroit, MI 1971.]

Calling All CMN Champions for the 2024 AC&E!

Earlier this week, we sent a letter asking Michigan credit union leaders to be Children’s Miracle Network (CMN) Champions in 2024. I want to take a moment to say a little bit more about this opportunity.

I know February just began, but here at MCUL, we’re already thinking about the 2024 Annual Convention & Expo (AC&E). We want to make this year’s event, which marks MCUL’s 90th anniversary, a great success.

If you’ve attended previous AC&E events, you know that we focus the week’s fundraising efforts on Credit Unions for Kids, a collective nonprofit that benefits CMN Hospitals. This year’s AC&E, in Traverse City from June 5-7, we are calling on you to be a part of the action! MCUL has formed a new “CMN and Other Charitable Activities Committee” to engage our credit union community in organizing these events and making an even stronger impact.

The following are the 2024 events: the CMN Golf Outing on June 5; CMN Live Auction on June 6; and CMN Fun Run on June 7. The Silent Auction will also begin a week before AC&E and will run until the conclusion of the Live Auction event.

Last year, the Michigan credit union movement came together through these events to raise $102,176 for CMN! All these efforts go to support the wonderful work of our Michigan-based CMN Hospitals – Sparrow Hospital in Lansing, Beaumont Children’s in Southfield, Hurley Children’s Hospital in Flint and Helen Devos Children’s Hospital in Grand Rapids.

So, how can you become a CMN Champion? It’s simple. We need credit unions and chapters to be CMN Champions and help us sponsor these events.

Right now, we need contributions for the CMN Silent and Live Auctions. Donations help us purchase fun items and packages for the event that enable us to leverage these donations even further, and we need to get started!

We’re hoping, for 2024, we can go above and beyond what we’ve done in the past. We see what a difference our efforts make for CMN Hospitals and their patients, and we want to make this year’s auction event another resounding success!

I want to encourage you to consider giving at a $5,000 (Large Asset/Chapter), $2,500 (Medium Asset/Chapter) or $1,000 (Small Asset) level – BUT, any amount is deeply appreciated!

Checks can be sent to our MCUL Lansing Office at:

Michigan Credit Union League & Affiliates

ATTN: CMN Auctions Contribution

110 W. Michigan Ave, Suite 100

Lansing, MI 48933

If you have any questions or wish to send your donation via ACH, contact Kieran Marion. We will be sending more information in the coming weeks about opportunities to support the Golf Outing and Fun Run.

January, 2024

Exciting Beginnings

In mid-January, I had the fun experience of moving my only child to Chicago to start her professional career in business consulting. As a recent college grad (Go Blue!), this is her first permanent, regular paycheck gig. Not only that, but it is also her first time living on her own, on her own dime (hallelujah), and setting up an actual home.

Having a front row seat to her first few days in Chicago, after driving the U-Haul to the big city and assembling a lot of furniture, I couldn’t help but get caught up in her excitement and reflect on my own early beginnings to a career.

I have a few solid memories on becoming a lawyer that stand out. First, learning that I passed the bar was a biggie. Getting sworn in was another. I also vividly remember the first time I put my appearance on the record in court as a litigator. It was in Pontiac district court and my client was a credit union. Flash forward to my MCUL career, I specifically remember picking up the phone in my law office when caller-ID showed that Dave Adams was calling. He was calling about an opportunity at the Michigan league and that call changed the trajectory of my career. (Thanks, Dave).

Remember your beginnings and the excitement and nerves that came along with it?! What memories stand out? So many “ifs” and uncertainties, right? For some of us, it’s imposter syndrome; the feeling that we are not qualified or capable. So many questions and not always answers to those questions.

For CEOs, walking into your office for the first time with an empty desk and blank walls. The feeling of excitement and pressure swirling in the air. There is really nothing quite like your first board meeting with all eyes on you!

There is a lot of focus on being present in today and not spending too much time looking back, but there is a lot of benefit to looking back at the road you traveled. That doesn’t have to wait for your retirement; you can take a pause and do it now! For some, it has been a long road; for others, the journey is just beginning. And we know that the road is not always straight. There are detours, dead-ends and plenty of ups and downs in the career journey.

I guess my point in all this reflection is to encourage you to bring some of the excitement you had at the beginning into to your current role and current time. Something nudged you or appealed to you along the way to get you where you are. What was it? I know with so many in our industry it was the desire to make a difference in people’s lives. What a great mission. We are so fortunate to work in an industry with such passion and purpose. While sometimes it may be hard to find one, let alone both, we proceed forward and rely on our credit union family.

I hope you know that you have people rooting for you and a great community of people who have been there! Trust that you are where you’re supposed to be and find joy in helping those who are just getting started -- whether that person is your kid or a new employee. Sharing that journey with them is so rewarding.

New Year, New Look

Welcome to 2024! I hope everyone is refreshed from the holiday season and ready to hit the ground running. To usher in this new year, the Michigan Credit Union League is unveiling a fresh face for our website, MCUL.org!

This has been a long time coming, and we’re very excited to debut a website that not only has an up-to-date look, but also a new layout that will make it easier for members to find what they’re looking for.

A big part of the redesign process was trying to understand how members use the page most so that we could tailor this new look appropriately. We believe the updated navigation will make your MCUL.org experience a more efficient one, going forward.

But don’t worry, that doesn’t mean you won’t be able to find all the same resources and updates that you previously could on MCUL.org — now, it will just be more straightforward.

As our site is new, we welcome feedback on your experience. Let us know how you like it or if you have suggestions for improvements. Thanks to our amazing IT team - led by Timmy Bohlman - and our communications team led by Rick Weaver, for this big undertaking!

For any feedback, as well as questions or concerns you may have about the new website, contact us at communications@mcul.org.

December, 2023

Holidays + Connection

This time of year, not only are we getting together with family and friends to celebrate the holidays, but we're also connecting with team members for end-of-year gatherings and boards for the final meetings of the year and direct reports for reviews! There is a lot of conversation and planning happening, that is for sure. I think most of us would agree that this is an exciting time as Jan. 1 feels like a clean slate — a new beginning, both personally and professionally.

I had a week of connection this past week with leagues from around the country at the winter meeting for the American Association of Credit Union Leagues (AACUL). We met with many of our industry partners, including CUNA (soon to be America’s Credit Unions), TruStage, NASCUS, the African American Credit Union Coalition, Filene and others. Being on the board and participating with AACUL is a great reminder to me of how our credit union system is composed of many moving parts all coming together with the mission to support credit unions and credit union members. It is a vast network of hard-working professionals that inspire me every day.

I am so proud of the hard work and endless commitment of our credit union team members and volunteers this year. Especially here at home, where I witness your efforts on a daily basis. I am proud to serve as the leader of your association, and look forward to walking arm-and-arm with you in 2024 as we navigate continued regulatory pressures, the complex political climate, financial stress on your members and an election year, together. Because, as we all know, together, we are stronger.

Thank you for the time you spend to read this publication and the support you give MCUL and our team throughout the year. From our entire team at MCUL, and me personally, have a wonderful holiday, and a happy and healthy new year!

November, 2023

Reflect and Be Recognized — MCUL & MCUF Awards are Open

During last week’s Thanksgiving, I had a chance to spend some time with family and friends. As can naturally happen during end-of-year traditions like this, you end up thinking about how the year has gone — taking stock of favorite moments, what I achieved, what I want to achieve next year, etc. It always centers me, allows me to appreciate my hard work while also thinking about where I want to focus my attention in the coming year.

In an operational sense, I know credit unions are doing the same thing during this Thanksgiving-to-Christmas stretch — assessing what’s working, discussing what areas need more attention and targeting new goals for the future.

Trust me, I know it’s a lot more difficult than I made it sound … but I do want to challenge credit union leaders to really focus, in the midst of all this strategic planning, on your successes in 2023.

Whether it was an innovative lending program, a financial education initiative, community-based grants or any number of other ways that I personally witnessed Michigan credit unions finding ways to serve our state, you deserve to be recognized.

The 2024 MCUL & MCUF Awards nominations are open right now, and it’s a great time to put those reflections into words so we can recognize you and your credit union at next year’s award ceremony. For those of you who have attended the ceremony in the past — or if you have been a recipient of an award — you know how special the event is and the feeling of appreciation for being recognized. Why not share the event and nominate someone with the chance to give them time on the stage and be recognized for their efforts?

And while these awards are designed to reward Michigan credit unions, chapters and professionals who are improving our state through innovation and dedication, your projects also inspire other credit union leaders to reach new heights.

The nominations are open through Jan. 8. You can find awards nominations and individual award information here.

Everyday Giving

Thanksgiving is just around the corner — a time when families come together and pause from the routine of worklife for a few days in order to celebrate each other’s company and appreciate the life around them. In other words, it’s a way to not take what we have for granted.

One thing that I never take for granted is that working in the credit union movement means much of my worklife is already organized around giving. Sometimes, that means hiking to DC to advocate for legislation that makes it easier for credit unions to serve members. Other times, it simply means seeing, on a daily basis, how much credit unions give back to your communities for the simple fact that you care.

Later this month, I have the honor of taking part in this first-hand as we give a check to the Children’s Miracle Network (CMN) Hospitals for our 2023 donation totals. This year, through MCUL’s silent and live auctions, fun run, golf outing and matching donations, we raised a total of $102,176 for CMN!

Later this month, I have the honor of taking part in this first-hand as we give a check to the Children’s Miracle Network (CMN) Hospitals for our 2023 donation totals. This year, through MCUL’s silent and live auctions, fun run, golf outing and matching donations, we raised a total of $102,176 for CMN!

While MCUL is giving out the check, we know this is a testament to how well Michigan credit unions understand the importance of these funds, which are going toward medical equipment and care that will make life easier for CMN patients.

In addition to working with our credit unions, I recently had the honor of being named to the Lighthouse of Michigan Board of Directors. The mission of Lighthouse is to build equitable communities that alleviate poverty. This past weekend, myself and the other members, assembled Thanksgiving food boxes for families that may not otherwise have a Thanksgiving dinner. While joining another board gave me pause simply due to my other time commitments, I am so glad that I said yes. I needed to round out my board work to include this kind of work. The kind of work that while you are doing it, you are reminded how fortunate you are. As we know, especially in these times, sitting down to a Thanksgiving meal is an absolute privilege that far too many people will not have this year.

It’s humbling to see how organizations across the state, including our movement, have made giving a part of the everyday mission. For credit unions, giving isn’t a reaction, it’s an inherent part of what we do. And I’m thankful that I get to be a part of it.

October, 2023

Back to Our Cooperative Roots

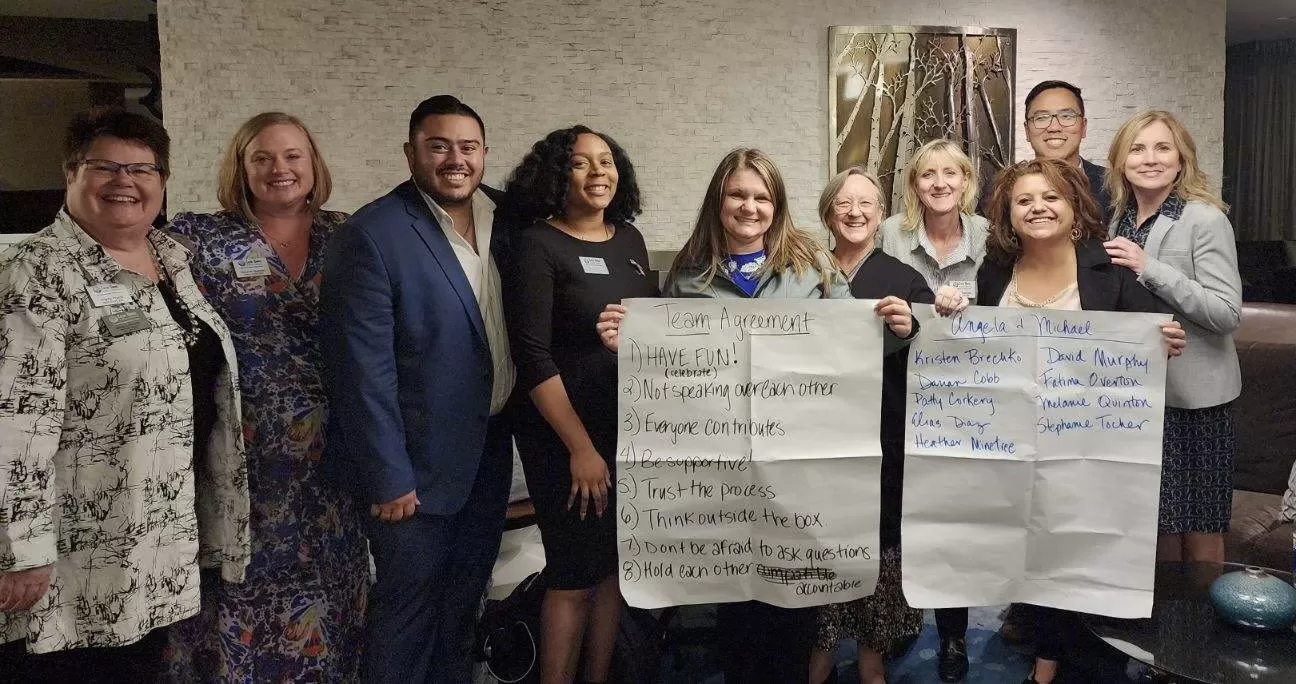

You may have seen on social media that I was privileged to attend the National Credit Union Foundation (NCUF)’s Credit Union Development Education course in Madison last week. I am officially a DE!

You may have seen on social media that I was privileged to attend the National Credit Union Foundation (NCUF)’s Credit Union Development Education course in Madison last week. I am officially a DE!

About a year ago, I had no idea what a “DE” was. I would see “CUDE” by some credit union people’s names in a signature block or on LinkedIn but I just wrote it off as a certification of sorts. Then, last year, I was listening to NCUF’s Gigi Hyland present, and she asked how many “DE”s were in the room. A smattering of people around the room proudly stood, claiming to have been in “the best class ever!” Some were new faces but a lot of them I have long admired for all their years in this awesome industry. I was intrigued. Not wanting to be left out of this prestigious group, after hearing Gigi explain the program, I told her that I was all in.

At first, I thought that spending time with the credit union cooperative principles was something just for new people to our industry. I quickly learned that this was not the case. Longtime credit union folks attend this week-long “course” alongside newbies to either learn for the first time or get re-inspired with our cooperative roots and all the current development issues that remain and need our desperate attention – development issues like hunger, savings, health, housing, diversity and equity, just to name a few.

So last week, I rolled up my sleeves along with over 50 others from around the country to talk about “the onion” and where leagues and credit unions fit in to the system along with our cooperative principles: voluntary and open membership; democratic member control; member economic participation; autonomy and independence; education, training and information; cooperation among cooperatives; concern for community and, in the U.S. we have added: diversity, equity and inclusion.

On day one of training, we were placed into a team of nine and worked the entire week with this new “family” of credit union people. Good people. Fun people. Smart people who were new or old in our industry and all wanted the same thing out of the week as me – to learn, open my mind and learn how I can make an impact. Mission accomplished!

We laughed, a lot. We visited a food pantry outside of Madison and felt, a lot. We worked on a project with our hypothetical credit union on how to tackle some of our country’s biggest development problems, like hunger and education. We then present our solution to the entire conference. We had late nights and early mornings. Did I mention we had fun?! We did.

What I really loved about the week was that you leave your titles at the door. No one knows what your job is and it’s a level playing field for everyone. It’s not until the afternoon of the final day – at graduation – where you share your title. It was fun to leave my CEO title off to the side and listen and learn from my group, our presenters and amazing mentors.

We ended the week with a challenge: to take back to your credit union or league what you learn and work on a project. My first step is to shine light on this program and encourage you all to consider going or sending someone from your team if you haven’t already. Meanwhile, if you are a Michigan DE, send me a note and let’s connect our DE possie! Check out: https://www.ncuf.coop/development-education/program/ for some more information. I am also happy to meet up and talk more.

In closing, you will see CUDE by my title now and I am thrilled to tell you that the October 2023 class was the best class ever. Become a DE and this will make sense!